Coral Reef Ecology-2018-05 2.0

ECO 140-Sustainability-2018-05-v1.0

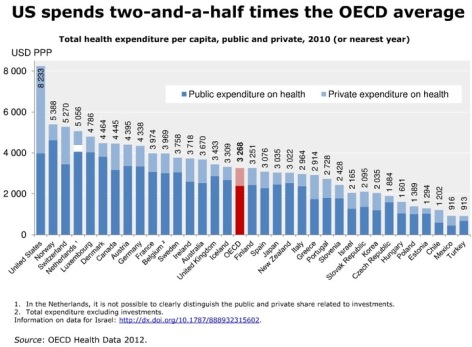

Healthcare is both a basic human right and it has also become an expensive entitlement. Therefore, how to deal with it is a great and extremely complicated conundrum for society. (Who knew?)

HEALTHCARE AND POLITICS

When it comes to the ACA (Obamacare), neither Republicans nor Democrats can see straight when talking about how to fix it, or what to do about healthcare in general for that matter. Both are now citing cherry-picked numbers to support positions that are often at odds with their espoused philosophies.

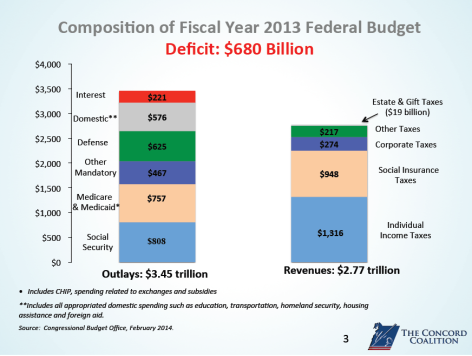

First, Democrats don’t want to accept that Obamacare is slowly collapsing or at best not working very well. Among the issues: the young and healthy are not enrolling in sufficient numbers, insurers are pulling out of the exchanges in many states, and costs are going up (albeit less than they might have otherwise). Democrats will also not fully acknowledge how expensive healthcare has become for federal, state, and local governments, both for their pensioners and the general population. With the rising cost of care and aging population, financial distress on many levels is a certainty.

Second, Republicans should be defending the ACA, since it was based on the conservative principle of an individual insurance mandate originated by the Heritage Foundation. Instead, Republicans have been railing about the “government-imposed” mandate for seven years and are now, in light of the CBO projections for their plan, touting the freedom of choice that Americans will finally have not to be insured.

The Heritage Foundation, in a proposal published in 1989, also points out, quite importantly, that healthcare is fundamentally different from any other market. This is something that Republicans either don’t understand, or do and are pretending otherwise for political purposes. (For the key Heritage Foundation passages, go to the later part of this post.)

So why have Republicans been agitating their supporters for 7 years about the ACA? Besides the obvious opposition to anything associated with Obama, the deeper reason has to do with how the ACA subsidies that expand coverage for those with lower incomes are paid for through various types of higher taxes on corporations and the wealthy. Therefore, the Republican replacement plan eliminates many of these taxes in order to please their higher income donor base, unbeknownst to a large part of their political base of more rural, middle and lower income voters. Now that Republicans are in power, many of them seem to care less about the fiscal deficit implications of anything and will use this argument only when it suits them.

WHAT DEMOCRATS WOULD HAVE PREFERRED

Democrats would have preferred at least a Public Option (a government-run health insurance agency that would compete with private health insurance companies), if not Single Payer (Medicare for all, but with private providers of health care), if not a full government-run national healthcare service (e.g. Great Britain, Canada, veteran care in U.S.). Democrats are pleased that coverage has expanded to more uninsured, including such provisions as no denial of coverage based on pre-existing conditions, children staying on their policies until age 26, etc.

REPUBLICANS SHOULD HAVE LOVED OBAMACARE

Under the ACA, private provision of healthcare and insurance were, for the most part, maintained, along with competition for both in the exchanges. For insurance to remain private, it must be profitable. To be profitable, large risk pools are needed so that the young and the healthy can support the sick and the elderly. This works well for employer-based plans, but not in the individual market. Until Obamacare, conservatives were really bothered by free-riders on the healthcare system, i.e. the poor and uninsured who would use hospital emergency rooms for care, where they could not be turned away. This was thought to be irresponsible and had the effect of raising everyone else’s insurance costs. Enter the insurance mandate, that idea that originated by Heritage and put into practice by Mitt Romney and the Democratic legislature in Massachusetts.

HISTORY REPEATS ITSELF

When Obama took office, he decided to do health care first in order to get on with other things and rammed it through without Republican support, which they weren’t going to give anyway. The Republicans are now doing the same thing. They are rushing through “Repeal and Replace” to get on with their agenda of tax reform (much needed actually) and deregulation (simplification and streamlining is needed, but not slash and burn). The end result is that neither Obamacare nor Trumpcare/Ryancare will be bipartisan or likely to work in the long run. Meanwhile, rebuilding our infrastructure, which everyone agrees needs to be done, will be delayed.

WHAT NEEDS TO HAPPEN

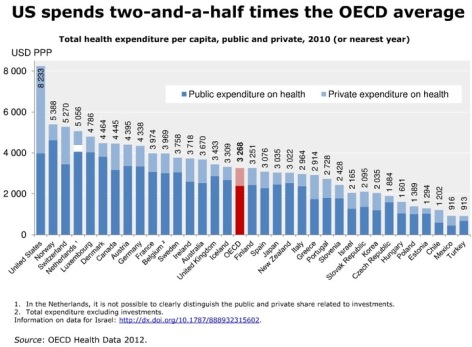

So how does universal healthcare get paid for? Most other developed countries manage do it with 7-10% of their GDP devoted to healthcare, compared to about 17% for the U.S. They don’t all do it with socialized systems or waiting lines either.

This is the subject of another post, but there are several essentials. First, everyone needs to be covered in order to spread the risk. Second, there needs to be greater emphasis and incentives for preventive care. Third, there needs to be an honest conversation about end of life care, which may account for a third or more of total lifetime health care expense. Almost everyone I know says that they do not want extraordinary measures taken, but then that seems to be exactly what happens within families when that time arrives.

Another honest conversation that needs to be had is, if health care is a basic human right, where do we draw the line for what society can or should pay for? For example, does everyone really have the right to multiple organ transplants? When the brain can be augmented by digital implants or the mind of an elderly person can be transferred to an android body, will it be fair or right that only the wealthy can afford immortality?

HERITAGE FOUNDATION PROPOSAL

Finally, the key passage (unedited from their 1989 proposal). Remember, this is a very conservative think tank.

Mandate all households to obtain adequate insurance. Many states now require passengers in automobiles to wear seat belts for their own protection. Many others require anybody driving a car to have liability insurance. But neither the federal government nor any state requires all households to protect themselves from the potentially catastrophic costs of a serious accident or illness. Under the Heritage plan, there would be such a requirement.

This mandate is based on two important principles. First, that health care protection is a responsibility of individuals, not businesses. Thus to the extent that anybody should be required to provide coverage to a family, the household mandate assumes that it is the family that carries the first responsibility. Second, it assumes that there is an implicit contract between households and society, based on the notion that health insurance is not like other forms of insurance protection. If a young man wrecks his Porsche and has not had the foresight to obtain insurance, we may commiserate but society feels no obligation to repair his car. But health care is different. If a man is struck down by a heart attack in the street, Americans will care for him whether or not he has insurance. If we find that he has spent his money on other things rather than insurance, we may be angry but we will not deny him services – even if that means more prudent citizens end up paying the tab.

A mandate on individuals recognizes this implicit contract. Society does feel a moral obligation to insure that its citizens do not suffer from the unavailability of health care. But on the other hand, each household has the obligation, to the extent it is able, to avoid placing demands on society by protecting itself.

Provide help to those who cannot afford protection. A mandate on households certainly would force those with adequate means to obtain insurance protection, which would end the problem of middle-class “free riders” on society’s sense of obligation. But of course there are many lower-income households who could not reasonably afford to meet that obligation and yet are not eligible for current direct assistance programs such as Medicaid.

To an extent, the problems of affordability among these families would be dealt with through the system of tax credits outlined above. The Heritage plan also sees these tax credits as refundable – that is, a check would be sent to the family if the total credit exceeded the tax liability. In t his way, families would receive direct assistance through the tax code to enable them to fulfill the obligation to obtain insurance. Nevertheless, there are certain families for whom even this assistance is not sufficient. Families with a very long history of health problems, for instance, may find insurance prohibitively expensive, even with generous tax benefits. In these cases, the Heritage plan envisions an expansion of subsidized risk pools operated through the states. Many states have these plans, in which high-risk individuals are pooled together, and then insurers are invited to compete to cover the pool with rates subsidized by the government.