The well-off are back to partying and politicians are arguing over the bar tab

The U.S. and world economy almost went down the drain in 2008-09, but thanks in part to extraordinary measures by the U.S. Federal Reserve and central bankers around the world, economic collapse was avoided. Although the lights are back on, the rate of economic growth remains below the escape velocity rate needed to move forward. While corporate profits are up and the stock market is at record highs, many on the lower decks are still cleaning up the mess if they are even back on the boat. Perhaps it is time to rethink economics as we know it. (More later.)

In the meantime, let’s look at some key indicators.

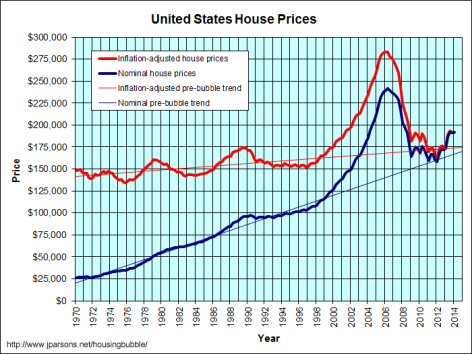

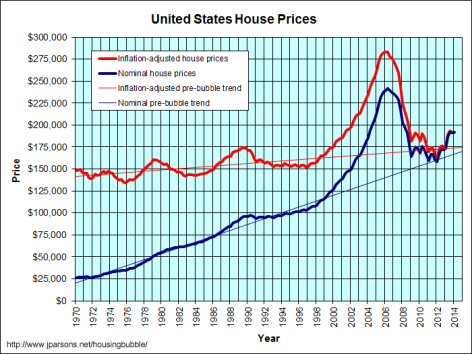

Housing

During the credit and housing bubble of the 2000s, people wanted to believe that rising home prices (values) were real and behaved as if they would continue indefinitely. It is obvious from the chart that home prices could not keep increasing at an exponential rate and that this was a bubble. The collapse in housing prices has stabilized at about trend level, yet some areas are starting to show signs of above-trend growth and certainly everyone who owns a home would love to see the values at the peak of the bubble and then go up from there. But how good would that be? The question is:

How and when do you get out of a bubble? What will be the next one?

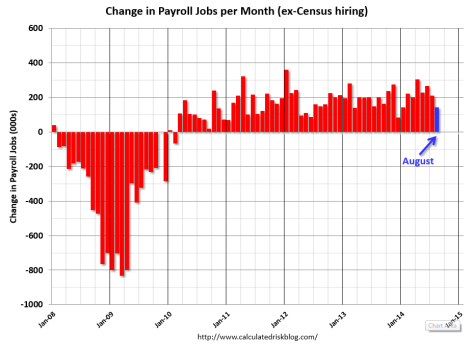

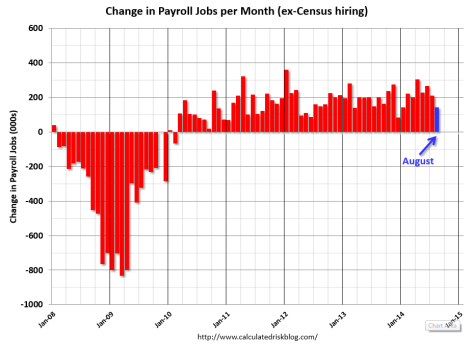

Employment

This graph (above) shows the the net nonfarm payroll jobs added each month from the federal government’s Establishment Survey of businesses. While we have substantially recovered since the depths of the Great Recession, keep in mind that:

- Job growth at current rates is barely enough to keep up with population growth from births > deaths and immigration (125-150k/month)

- Job losses from the recession need to be made up in order to return to a prerecession “normal”

- Job looses during the depths of the recession were even greater than it might first appear since the 125-150k jobs not added to keep up with population growth were also lost in addition to the actual losses

Comments and graphs from August’s employment report at Calculated Risk can be found here and here.

Economic Growth

Q2 growth of 4.2% (annual rate) is encouraging but may be a bounce back from the Q1 drop which has largely been attributed to weather. 3% is considered to be the “normal” or trend economic growth rate for the U.S. After a recession, there needs to be a rebound above trend to make up for lost growth and bring back lost jobs. The recovery that we have had has required extraordinary fiscal and monetary stimulus (see next chart).

What if the new normal without support is only 1-2%?

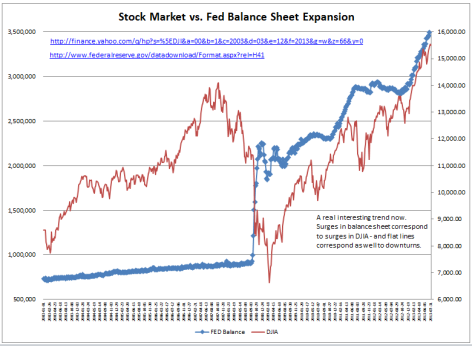

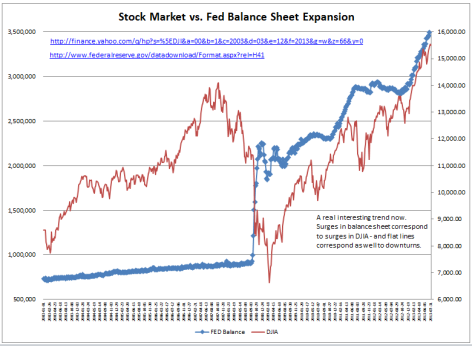

The Stock Market and the Fed

Mish – Global Economic Analysis (2013)

The Fed Balance Sheet (monetary base) is now just over $4 trillion as the Fed winds down QE (printing more money) by the end of the year. In addition the Fed Funds interest rate (the rate that underlies all other rates) has been at near zero since 2008. It suggests that there is something fundamentally wrong.

Without these extraordinary steps, where would the stock market and economic growth be?

Federal Deficits and Debt

The first chart illustrates the demographic challenge posed by the baby boomers’ retirement, which they have neither saved nor taxed themselves enough to pay for.

The second chart illustrates the resulting financial challenge.

Federal debt results from federal spending exceeding federal revenues (taxes) over the long run. The largest components of federal spending are defense, Medicare, and Social Security. The latter two will grow substantially as the baby boomers retire. Federal debt has two components:

- Debt held by the public: money the government borrows on the open market from domestic or foreign investors

- Intra-governmental debt: money the government owes itself, as in the Social Security and Medicare trust funds

This chart (above) shows only the public debt. The Social Security and Medicare trust funds are empty and will also need to be paid back by taxpayers. As the debt grows, so too will the interest. Interest rates are now at history lows due to Fed policy (see previous section on the Stock Market and the Fed). Currently the deficit situation is slightly better. As more and more baby boomers retire, spending (and debt, absent increased taxes) will rise. As the Fed winds down and reverses QE (money printing), interest rates will rise. Higher interest rates on more debt will compound and become completely unsustainable.

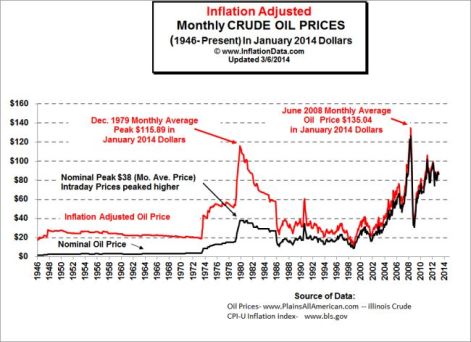

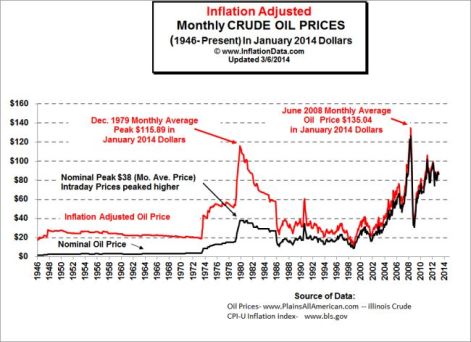

Another Key: Energy (Oil) Prices

The economic growth of the 50s and 60s and the American dream of suburbia may have depended, in large part, on low energy prices, especially oil. High oil prices in the 70s and resulting high inflation were the result of disruptions in the Middle East and OPEC embargoes. This time is different:

- OPEC realized that they would be better off in the long if the world became addicted to oil

- However, beyond the Middle East, the “low-hanging fruit” of cheap and easy oil is used up

- Oil prices only fell in 2008-09 as a result of the economic crisis

- OPEC has actually been helping to stabilize oil prices from going up (to avoid another world recession) and from going down (because they need the revenues)

- In addition, the oil we must now get from the Arctic, deep-sea, Tar Sands, and fracking requires oil to be $90-100 to be profitably worthwhile (3-4 times more costly than the economy is designed for)

Capitalism and a growing world population (that wants at least an American middle-class lifestyle) needs more growth than is now possible at today’s energy prices. This may not end well.

There is Also Climate Change

Much more in a future post.

Is There Hope for a Sustainable Future?

While politicians rearrange deck chairs on the titanic economy of the past, some entrepreneurial visionaries are laying the foundation for a new era. Will green shoots like this develop fast enough to save us from the economic distress of a shrinking economic pie or climate chaos?

Link exchange is nothing else but it is only placing the other person’s webpage link on your page at suitable place and other

person will also do similar in favor of you.

Hey guys, are any of you smokers? My friend who is going with me is, and I wanted to know if there is a smoking area there. If there’s not, what does one do? Is there reentry, so he can go outside and come back?

Hej!Jag har missat nyckelbytet, (har nycklar till hobbyrum, soprum och tvättstuga).Kommer det fler tillfällen att byta? MVHMimmi Staaf Möbelmakeri